Imagine having the ability to accurately forecast cashflow in your integration business!

Cash flow management has never been more important to integrators than it is now.

Cash flow management has never been more important to integrators than it is now.

Most integrators go through a great deal of effort calculating cash flow, but it’s often done in a spreadsheet.

When this happens, the biggest challenge is reliability of the data. Spreadsheets are also static and cannot be utilized as a living tool.

In today’s video, our CEO, Brad Dempsey, shares some best practices for standardizing inputs and outputs, and putting a tool in place that allows integrators see their cash position at any given time.

Step 1 – Understand all the processes that lead to invoicing

Let’s start with inputs. Integrators need to invoice customers to receive cash.

“You may have heard the term BEBO, or Bill Early Bill Often,” says Dempsey. “But we really liked the idea of BEBOBA, which is Bill Early, Bill Often, and Bill Accurately, because accuracy reduces disputes.”

That last piece about billing accurately is really critical. Getting your invoices out, systemizing and automating them by using a tool like Q360, makes a big difference for cash flow management.

Step 2 – Clear the path to get paid before the project starts

At the end of the sales process, but before you start work on a job, have the AR person at your integration business contact the AP person at your customer and find out what you need for invoices.

Where do you send them?

Do you need to reference the PO?

Do you need to reference PO line items?

Knowing this information will help improve cash flow all the way through the project.

Solutions360 is always talking about critical hand-offs and processes in integration companies. By having the salesperson document this critical contact information, it will create more of a seamless hand-off when the project manager takes over the job.

Step 3 – Make it easy for your customer to pay you

“You need to understand your market and be open to receiving checks, wire payments, ACH, or potentially even credit cards, as long as you evaluate the cost of the fees involved with credit cards,” says Dempsey.

Does your integration business collect deposits from your customers?

The lack of deposits is one thing that surprises Solutions360 about the integration industry.

“It’s amazing that a lot of integrators don’t even ask for deposits,” says Dempsey. “They don’t realize how many deposits they could actually get. And you don’t have to get them on all of your jobs. Let’s say you’re only getting deposits on 10% of your jobs right now. Just moving that needle to 30% will have a significant impact on your cash flow management.”

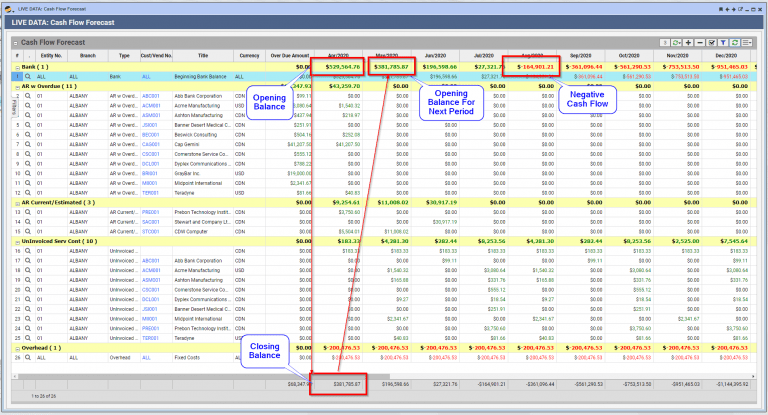

Imagine having the ability to accurately forecast cash flow for your integration business!

None of the information we want to forecast should be outside of what we need to properly run our business on a day-to-day basis. Data collection should not be a burden, it should be part of your standard processes. You want to be able to get this information from the processes that you are using to run your business anyways.

- Start with your bank balance.

- Add your inputs.

- Subtract your outputs.

- Graph this over a period of time.

- Part of your outputs are fixed costs, so apply that factor.

- This will allow you to create a visualization of what your cash position is going to be in the future.

Then when something happens, and it always will – you win a new deal, you lose a deal you didn’t think you were going to lose, a deal get delayed – so your cash flow forecast changes.

But having a tool, like Q360 gives you the ability to immediately see the impact of that change, giving you time to react with forethought, and the time to do something about it.

That’s where we all want to be.

Also on the video:

-

Tips for getting cash in the door after invoicing.

-

How to manage the cycle between when you order material, when you receive it, and when you get paid for it.

Watch the video for all this and much more!

Solutions360 2020 P2P Webinar video –

Best Practices for Cash Flow Management

Handpicked Related Content

-

We are excited to release the newly updated cash flow forecasting dashboard in Q360 Why is cash flow forecasting important? The object of cash flow forecasting is to compare how much cash you receive each month to how much cash…

-

How important is cash flow to your integration business? A blog post based upon The AV Profession podcast from AV Nation. Most integrators agree that having a backbone of solid cash flow is the lifeblood of an integration business. There…

-

This is the final installment in our blog series about cash flow management, and cash-blind owners. What are cash-blind owners, you wonder? Simply put, they are integration firm owners who are completely oblivious to the monthly cash flow activity of…