We are excited to release the newly updated cash flow forecasting dashboard in Q360

Why is cash flow forecasting important?

The object of cash flow forecasting is to compare how much cash you receive each month to how much cash you must disburse. Solutions360’s new worksheet tool will help you to forecast both sides of this equation.

This month-by-month look forward can help integrators manage growth, as well as predict any impending cash flow crisis.

7 Tips for accurate cash flow forecasting in your integration business

- Set Expected Payment Dates on Receivables – if you expect to receive them after their due date

- Set Expected Payment Dates on Payables – if you will be paying them after the due date

- Create Invoice Tasks on Projects – to forecast future project receivables

- Set Requested Date for Project Materials – to project when those expenses will be incurred

- Set the Fixed Cost Flag on GL Accounts – that you wish to include in your projected Overhead expenses

- Increase or Decrease the “Periods to Collect” – filter to see the effect of a more or less conservative collection strategy

- Use the Fixed Adjustment % – to see what effect lowering or increasing expenses has on cash flow.

How can integrators use the cash flow forecasting dashboard to help manage their businesses?

The Q360 cash flow forecasting worksheet allows you to run different scenarios, such as “What happens if I drop my fixed costs to 75% of what they currently are?”

Or, if you are looking at growth, you could ask, “What will happen if I raise my fixed costs to 125%?”

Let’s run through an example.

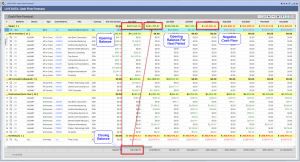

Looking at the dashboard above, the starting bank balance is $529K. As you move from month to month, you can see all the different invoices that are predicted to be collected, and how that affects ongoing balances.

When you look forward, you can see what the beginning cash balance will be every month. You can see when cash flow is positive, and when cash flow is negative, which varies depending on what invoices are collected each month. Based on this model, I am going to run into a cash crunch in October of 2020.

Watch the full video demo:

Solutions360’s New Cash Flow Forecasting Dashboard

Handpicked Related Content:

Handpicked Related Content: